人民银行扩大麻辣粉担保品范围是放水?房价要涨?德意志银行中国金

傻大方提示您本文标题是:《人民银行扩大麻辣粉担保品范围是放水?房价要涨?德意志银行中国金融状况指数:2016年末开始的金融紧缩周期已经停止》。来源是。

人民银行扩大麻辣粉担保品范围是放水?房价要涨?德意志银行中国金融状况指数:2016年末开始的金融紧缩周期已经停止。德意志银行|中国金融|人民银行|担保品|指数|麻辣粉---

"愤怒的小鸟崔蜀黍和冯小刚刘震云范冰冰等一大波艺人撕逼,让中国人民在一片仇富和八卦的狂欢中度过了好几天,却掩盖了很多重大的事情,人民银行扩大麻辣粉(MLF)担保范围就是可能关系到宏观趋势和你的投资路径的事情,有人说这就是中国版的QE,放水了,也有人说这没任何的影响,那么究竟是个啥呢?其实,中国很多宏观金融指标早就变样了,小编看到德意志银行专门编了一个新的指标,也可能有用吧"

。

扩大麻辣粉担保范围究竟是不是QE

首先,小编一直对人民银行上一届领导人周小川表示敬意,学习到了格林斯潘的精髓--模糊!在金融系统搞了一大堆老百姓搞不清楚的工具,其中最牛逼的是披萨饼PSL、麻辣粉MLF、酸辣粉SLF等,而在海外,也有QE,LIRO等工具,我们经常将帝国主义的这些工具称为印钞,不过我们的这些工具呢,小编个人觉得只能是呵呵!

德意志银行|中国金融|人民银行|担保品|指数|麻辣粉---傻大方小编总结的关键词

德意志银行|中国金融|人民银行|担保品|指数|麻辣粉---傻大方小编总结的关键词

德意志银行|中国金融|人民银行|担保品|指数|麻辣粉---傻大方小编总结的关键词

德意志银行|中国金融|人民银行|担保品|指数|麻辣粉---傻大方小编总结的关键词

德意志银行|中国金融|人民银行|担保品|指数|麻辣粉---傻大方小编总结的关键词

回说这次麻辣粉扩大担保范围的事情,首先搞清楚麻辣粉的目标要求是金融机构对于三农和小微企业的贷款,扩大抵押范围只是表示银行可以用以前不能抵押的东西,比如以前你给隔壁老王借钱,老王只要你的硬通货抵押,现在老王说你没硬通货了用的股票账户上的股票抵押也行,所以理论上起码来说第一银行可以从人民银行拿拿到更多的钱,但按照规定呢这些钱只能流向三农和小微企业,所以,再理论一下,第一这个钱不多,第二这个钱也不能流向房地产等,所以应该就不可能是中国版的QE。

但这是一种QE的情绪

但是呢,这是一种情绪的表现。尤其是在中国这样一个连大部分专业人士也搞不清楚央行的政策走向的时候,对于大多数老百姓来说,从心里里面你就是放水,你就是QE。

再来说,其实任何一个经济体膨胀的历史就是印钞的历史,就是通货膨胀的历史,4月末,中国广义货币(M2)余额173.77万亿元,新华社的数据图片让你清醒地

德意志银行|中国金融|人民银行|担保品|指数|麻辣粉---傻大方小编总结的关键词

看到这个数据是如何膨胀的。所以不管如何解释,虽然最近以来M2的增长速度趋势已经下降很多,但这就如一个巨大的通货膨胀的水库在上面压着,而大家心里也明白,中国没有恶性通货膨胀的原因第一个是房地产作为巨大的蓄水池,第二是很多在CPI篮子的东西生产过剩或者被调控,第三当然是很多指标根本不在CPI的篮子里面。

其实,这才是市场和普通老百姓对于人民银行扩大酸辣粉担保范围的心里恐惧。人民银行做的任何动作,都有一个巨大的心里暗示。是不是房地产要涨?是不是股市要涨?虽然这些东西都只有过去之后才能证明,但一切的心里情绪是必然发生的。

德意志银行新指标体系FCI:中国金融状况指数

前面提到,其实,即使是专业的人士,对于很多经济和金融指标都是非常糊涂的,所以以前很多专家都不看你的CPI,因为其实你可以调控,后来有人有专门看交通运输的数据,电力的数控,挖掘机的数据,但开始的时候正确,后来发现也不行了。

大概各大投行和中国各种统计机构之间也是相互博弈,到最后发现大多数指标都无法真的体系,因为各种噪音太多了,所以小编看到德意志银行搞了一个新的指标,中国金融状况指数,按照这个指数,中国的宏观调控不是我们现在说的一样呢,是不是如此,大家可以自己判断。

德意志银行|中国金融|人民银行|担保品|指数|麻辣粉---傻大方小编总结的关键词

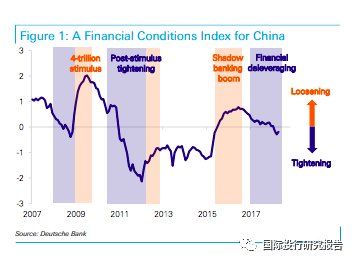

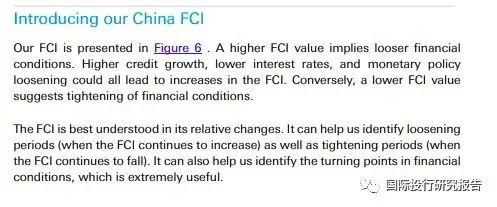

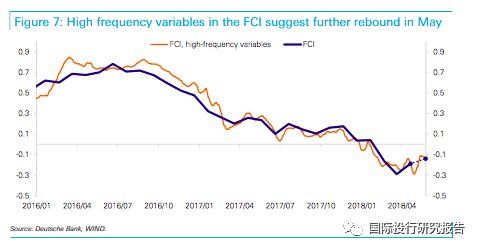

We launch a financial conditions index (FCI) for China in this report. The index works well as a summary statistic to indicate overall financial conditions in China, with its inflection points matching well with policy changes in the past decade ( Figure 1 ). The FCI shows that the financial tightening cycle that started in late-2016 has come to a halt.

我们在本报告中启动了中国金融状况指数(FCI)。 该指数很好地反映了中国整体金融状况的总体统计数据,其拐点与过去十年的政策变化相匹配(图1)。 FCI表明,2016年末开始的金融紧缩周期已经停止。

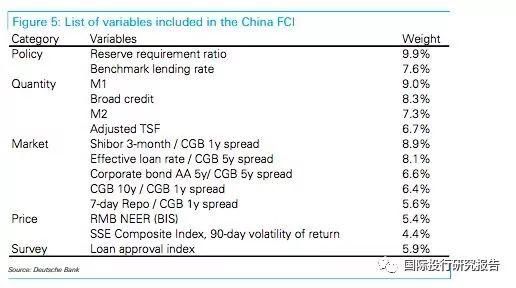

The FCI rebounded in April, likely due to a marginal relaxation of monetary policy over concerns of a trade war. We are grateful for the assistance of Xinyu Ji, an employee of Evalueserve, a thirdparty provider of research support services to Deutsche Bank. The index is based on 14 financial indicators that coverpolicy rates,market interest and exchange rates, quantities of money and credit, and equity market volatility. These indicators were chosen from a wider range of variables based on a principal component analysis (PCA). They are intended to reflect the impact of both monetary policy and financial regulations.

FCI在4月份反弹,可能是由于担心贸易战导致货币政策放松。 我们非常感谢德意志银行第三方研究支持服务提供商Evalueserve的员工Xinyu Ji的帮助。 该指数基于14个财务指标,涵盖政策利率,市场利率和汇率,货币和信贷数量以及股票市场波动。 这些指标是基于主成分分析(PCA)从更广泛的变量中选择的。 它们旨在反映货币政策和财务条例的影响。

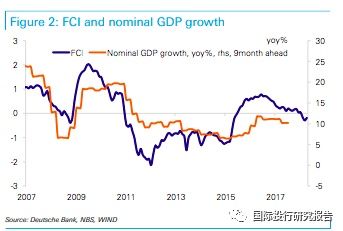

We did not choose the financial indicators to forecast any macro data. Nonetheless, the index works well as a leading indicator of nominalGDPgrowth (by 2-3 quarters, Figure 2 ). We would take the FCI as one useful input for forecasting the economic cycle in China, but investors should also look at other driving forces of the economy such as fiscal policy and trade. We will update the index regularly and publish it in our monthly China Macro in Charts.

我们没有选择金融指标来预测任何宏观数据。 尽管如此,该指数很好地成为名义GDP增长的领先指标(2-3个季度,图2)。 我们将FCI作为预测中国经济周期的一个有用的投入,但投资者还应该考虑财政政策和贸易等其他经济动力。 我们会定期更新指数,并将其发布在我们的月度中国宏观图表中。

德意志银行|中国金融|人民银行|担保品|指数|麻辣粉---傻大方小编总结的关键词

德意志银行|中国金融|人民银行|担保品|指数|麻辣粉---傻大方小编总结的关键词

Why do we need a China FCI?

为什么我们需要中国金融状况指标

China has a large financial sector that is crucial for its economy. Debt exceeded 250% of GDP in 2017, according to the BIS, most of which is borrowed through financial markets. Financial conditions can affect operational and investment decisions made by leveraged corporates, households, and local governments.

中国有一个对其经济至关重要的大型金融部门。 据国际清算银行称,债务在2017年超过了GDP的250%,其中大部分是通过金融市场借入的。 金融状况会影响杠杆企业,家庭和地方政府的经营和投资决策。

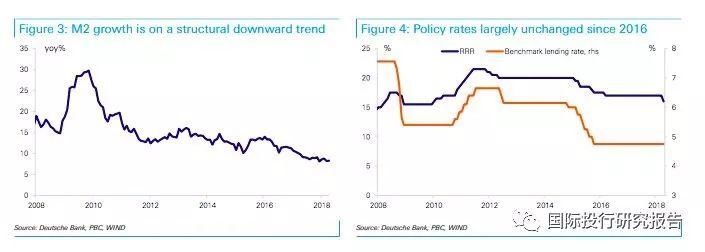

But assessing financial conditions in China today is not an easy task. Traditional quantity-based measures, such as M2 and bank credit, are losing their effectiveness owing to financial innovations. M2 growth has been on a structural downward trend ( Figure 3 ). Indeed, the PBoC recently noted that "M2's measurability, controllability and relevance to real economy are all declining" 1.

但是,评估当今中国的金融状况并非易事。 由于金融创新,传统的基于数量的措施(如M2和银行信贷)正失去效力。 M2增长一直处于结构性下降趋势(图3)。 事实上,中国央行最近指出,“M2的可衡量性,可控性和对实体经济的相关性都在下降”1。

China's monetary policy stance nowadays is not so obvious either. The PBoC's policy communications are not easy to interpret 2. Among the PBoC's wide range of policy tools, the benchmark lending rate and reserve requirement ratio (RRR) are widely recognized policy instruments but are almost unchanged in the last two years ( Figure 4 ). Conversely, the problem with OMOs is that they are too frequent and seasonally driven to ascertain monetary policy signals. Given the vast number of interest rates and prices available on the market, it is also difficult to pick out one rate that is representative of financial market conditions.

现在中国的货币政策立场也不是那么明显。中国人民银行的政策沟通不易解释2.在中国人民银行广泛的政策工具中,基准贷款利率和存款准备金率(RRR)是广受认可的政策工具,但在过去两年几乎没有变化(图4)。相反,OMO的问题在于,它们过于频繁和季节性驱动以确定货币政策信号。鉴于市场上存在大量的利率和价格,选择一个代表金融市场状况的利率也很困难。

德意志银行|中国金融|人民银行|担保品|指数|麻辣粉---傻大方小编总结的关键词

Aquantitative measure for financial conditions can greatly help navigate through all the signals and noises emitted by the PBoC and financial markets. FCIs are summary statistics that extract information from a broad set of financial variables: policy and market interest rates, exchange rates, credit and money supply, asset prices, etc. It is common practice nowadays in DMs to use FCIs to quantitatively measure financial conditions. Although the concept of FCIs is widely agreed upon, the actual compilation of FCIs is by no means standardized. 3 Our DB colleagues in the US and Europe regularly update and analyze their own FCIs 4.

对金融状况进行量化衡量可以大大帮助中国人民银行和金融市场发出的所有信号和噪音解决问题。 FCI是摘要统计数据从一系列广泛的金融变量中提取信息:政策和市场利率,汇率,信贷和货币供应量,资产价格等等。现在DM中常见的做法是定量使用FCI衡量财务状况。 尽管FCI的概念得到广泛认同,FCI的实际汇编决不是标准化的。

3我们的数据库同事在美国和欧洲定期更新和分析他们自己的FCI4。

德意志银行|中国金融|人民银行|担保品|指数|麻辣粉---傻大方小编总结的关键词

德意志银行|中国金融|人民银行|担保品|指数|麻辣粉---傻大方小编总结的关键词

Abrief review of recent history should help readers better understand the FCI:

■ 2008-09 loosening: When the global financial crisis broke out, the famous "4trn stimulus package" was announced in early Nov 2008. Credit conditions eased significantly to accommodate this package. Our FCI rose sharply from -0.4 in Oct 2018 to 0.5 in Dec, and further to 2.0 in June. It fell slightly afterwards but remained above 1 in 2009 and Q1 2010, suggesting that financial conditions remained loose.

■ 2010-11 tightening: The turning point was in May 2010, when inflation overshot to above 3%. The PBoC hiked the RRR in May, while tighter financial conditions also stemmed from higher interest rates and a drop in stock prices. The steepest tightening in China's recent history happened between late 2010 and 2011, when the PBoC hiked the RRR nine times and the benchmark rate five times in just eight months. Our FCI fell by more than 2.5 standard deviations, from 0.8 in Oct 2010 to -1.9 by end-2011.

■ 2012-14 liquidity shocks: By early 2012 inflation was under control, and financial conditions eased somewhat in 2012. But overall financial conditions remained tight in 2013-14, as our FCI fluctuated at around -1. Notably, the two cases of "liquidity squeezes" took place in mid- and end-2013, when market rates rose sharply over liquidity shortages. These were clearly shown by movements in the FCI.

■ 2015-16 loosening: After the stock market crash in April 2015, policies started to ease rapidly. Easing continued into 2016 amid concerns over a China hard landing and stability of the RMB. Our FCI flipped from -1.2 in early 2015 to 0.8 by mid-2016. As the PBoC eased policy rates, financial regulations also loosened, and the shadow banking sector boomed.

■2016-17 tightening: The most recent round of tightening began in late 2016. The FCI peaked in August and started to fall afterwards. This round of tightening was milder than in previous tightening cycles, judging by a much flatterFCIcurve. An important phenomenon of this period was that tightening did not come from higherpolicy rates;rather, it was largely driven by quantity variables, notably deleveraging in the shadow banking sector.

德意志银行|中国金融|人民银行|担保品|指数|麻辣粉---傻大方小编总结的关键词

德意志银行|中国金融|人民银行|担保品|指数|麻辣粉---傻大方小编总结的关键词

- 人民日报:完善网络安全军民融合新格局

- 人民日报评论员:筑牢国家网络安全屏障

- “跟着人民日报领悟新思想”之二:习近平情系绿水青山

- "跟着人民日报领悟新思想"之一:总书记种下"信心

- 人民日报评论员:建设高素质专业化教师队伍 ——论学习贯彻

- 快递员被曝强暴客户 人民日报:快递公司应守土尽责而非失语

- 民进党理政无能亦无心 根本不为人民考虑

- 8月新增人民币信贷 达1.28万亿

- 银保监会严查信贷资金违规流入房市 多家银行遭罚

- 斯威士兰正着手与中华人民共和国建交?国台办回应